Kearney: Average travel retail spend per passenger collapsed 29% in 2022

The findings appear in Kearney’s new report conducted for the Tax Free World Association, Travel retail faces its moment of truth: strategies to reinvigorate the marketplace, developed from industry data and a survey of 3,500 customers across 10 countries.

Leading global management consultancy Kearney has released new data highlighting concerns about the travel retail industry, noting that slow recovery from the pandemic and the end of “revenge buying” has prompted a disconnect between price-centric models and new customer expectations.

The findings appear in Kearney’s new report conducted for the Tax Free World Association, Travel retail faces its moment of truth: strategies to reinvigorate the marketplace, developed from industry data and a survey of 3,500 customers across 10 countries.

The end of “revenge buying”

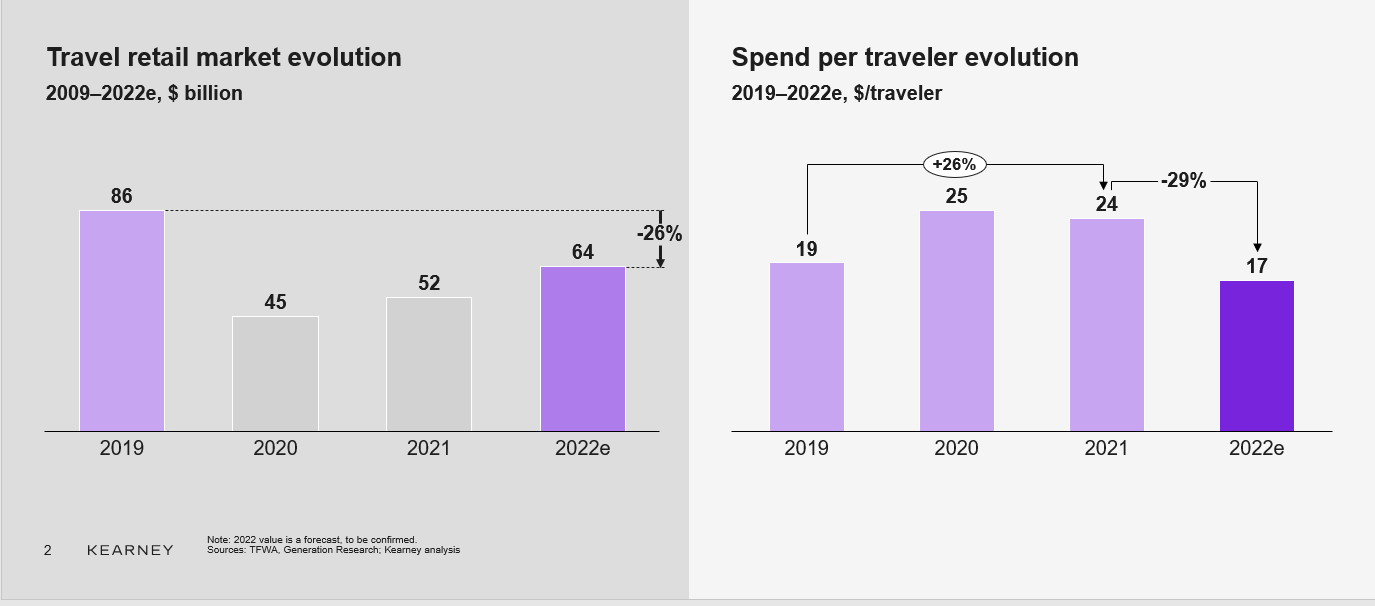

COVID abruptly disrupted a decade of fast-paced growth (+9% per year) in the retail travel market. The market is expected to recover in 2022 to 75% of its 2019 value, but a full recovery will not happen before 2023–2024 and will mostly be supported by increased passenger numbers. In 2022, passenger numbers reached 75% of 2019 figures—and global traffic is expected to fully recover by 2024.

However, Kearney’s report observed that the average spend per traveler fell 29% in 2022—to just $17. This may be in part due to a reduction in “revenge buying”—excess consumer spending following the pandemic—or the effect of inflation. However, the data reveals that the disconnect between consumer expectations and the current travel retail model is also a significant factor.

Figure 1: Despite market recovery, spend per traveler in 2022 was 29% below 2021 levels.

Travelers’ expectations have shifted

Traditionally, price competitiveness has been central to the travel retail industry’s value proposition. However, Kearney’s research reveals that more than 50% of travelers do not perceive travel retail prices as competitive compared with domestic retail, and 33% do not buy because the product assortments don’t fit their expectations, leading to a conversion rate that is much lower than traditional shopping centers. In fact, only 5 to 10% of travelers buy in airport duty free stores, compared with 40 to 60% of visitors in shopping centers.

New generations are changing the rules

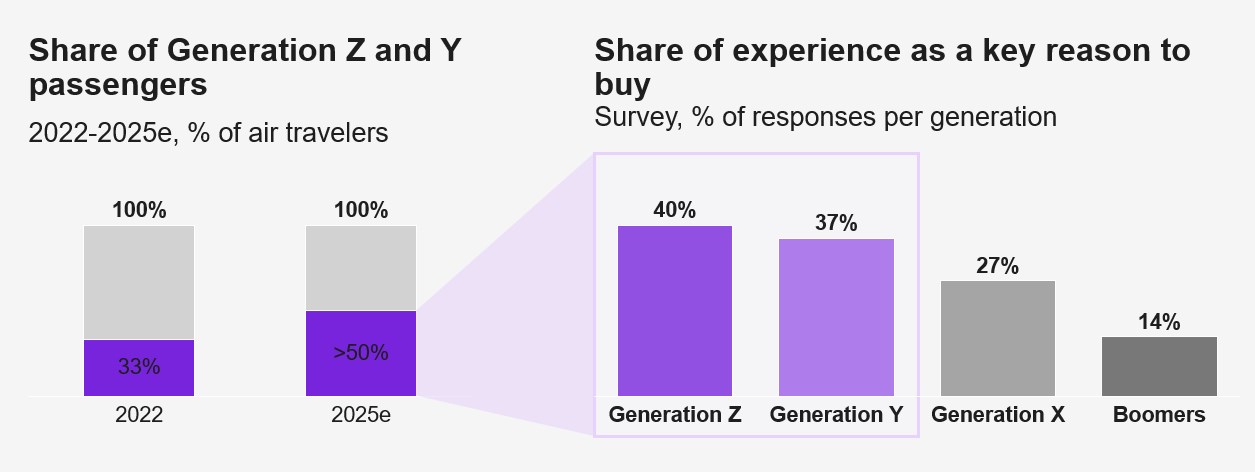

Gen Z and Millennials are becoming a larger segment of the traveling population, predicted to be more than half by 2025 and representing a new kind of traveler. For instance, 77% of passengers mentioning experience as a key reason to buy duty free were either Gen Zs or Millennials, while older travelers tended to prioritize cost over experience.

Figure 2: The evolving passenger mix: Gen Zs and Millennials will make up 50% of travelers by 2025.

Passenger flow could help …

Global passenger numbers will recover to 83% of 2019 levels this year (3.74 billion) and then 101% of 2019 levels by 2024 (4.55 billion), according to Kearney’s report. However, traffic volume is not the same as consumption growth. To ensure consumption growth, there needs to be a fundamental shift in the industry’s value proposition.

… but the travel retail industry will need an essential regeneration to secure its future

In addition to competitive pricing and promotion, travelers want to have the right assortment, personalized engagement, a tailored shopping experience, and top-notch services. According to Kearney’s study, 55% would buy more with more competitive prices, 37% if exclusive products were offered, and 17% if delivery was available; and 32% mention experience as a key reason to buy.

“The pandemic was clearly a significant shock to the travel retail industry—and one it is still recovering from,” said Charles-Etienne Bost, Kearney partner and head of the consumer goods, retail, and luxury business for Europe. “However, while the pandemic was a black swan, the underlying factors that have necessitated a rewiring of global aviation and travel retail were lurking even before the first headlines from China. The important thing will be to recognize how passenger behaviors and trends around travel have changed.”

Vincent Barbat, Kearney partner and lead of luxury business for Europe, adds: “The ‘trinity model’ of airports—retailers and brands worked it for years. Now, it’s time to update our thinking around travel retail. A pentarchy model, adding in carriers along with digital and media partners, now better describes the distinct forces that need to be present to best serve air travelers and their needs. This isn’t to suggest some rosy cliché that we all simply need to work together. It’s a pragmatic, profit- and growth-driven approach to keep the new trends that are influencing duty free consumers at the center of business models for a new age.”

John Rimmer, managing director at the Tax Free World Association, concluded: “As with any retail industry, the priority for dutyfree and travel retail is to understand current and future customer behaviors, anticipate their needs and expectations, and tailor the retail offer and assortment accordingly. It is difficult to promote our industry when we are unable to accurately define the level of sales it generates, and therefore, the contribution we make to the travel industry worldwide. Initiatives such as this report from Kearney and the European Travel Retail Confederation Index are steps in the right direction, but it requires a coordinated global approach with the cooperation of all stakeholders.”

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor’s degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.